2024 Premium Tax Credit Income Limits

2024 Premium Tax Credit Income Limits. 2021 and 2022 ptc eligibility. How have the income limits for aca premium subsidies changed?

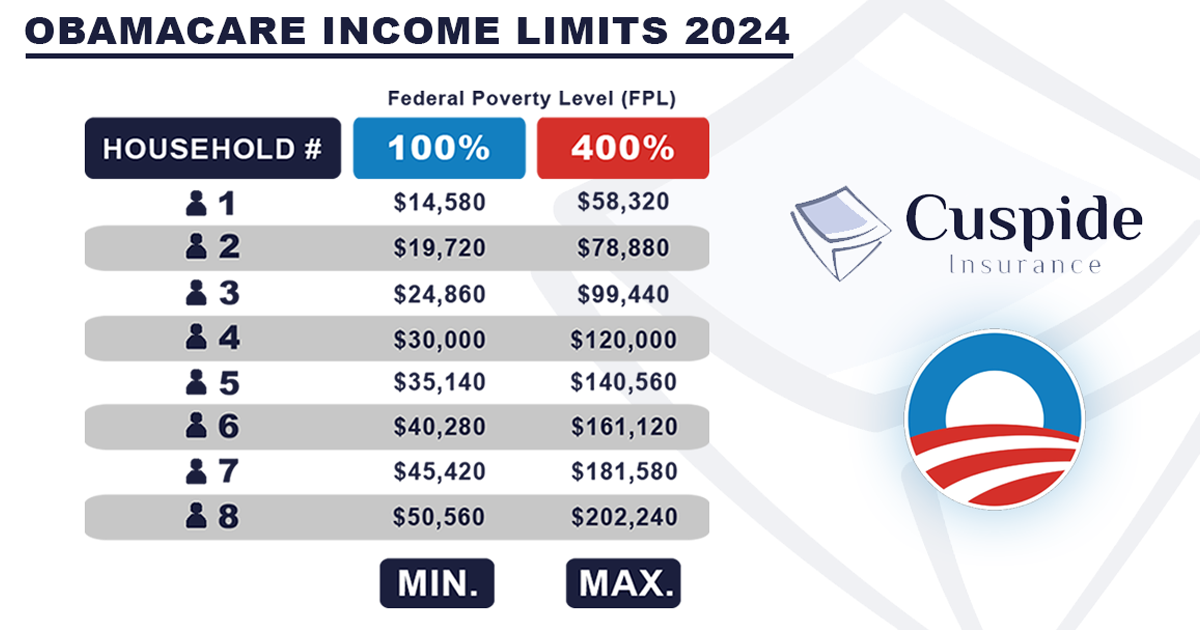

For a family of four, that means an income of at least $30,000 in 2024. What are the advanced premium tax credit repayment limits?

There Are Also Dollar Caps On.

The income limits for minnesotacare are for 2024 coverage.

2021 And 2022 Ptc Eligibility.

To be eligible for premium tax credits, you must meet the following criteria:

This An Increase From The 2022 Range.

Images References :

Source: thomasinewjosee.pages.dev

Source: thomasinewjosee.pages.dev

Federal Poverty Level 2024 Massachusetts Randi Carolynn, Congress has extended relief through 2025 for taxpayers who purchase health insurance on a marketplace exchange and want to take advantage of the. For the 2024 tax year, you must repay the difference between the amount of premium tax credit you received and the amount you were eligible for.

Source: www.zrivo.com

Source: www.zrivo.com

Premium Tax Credit 2023 2024, In previous years, household incomes had to be between 100% and 400% of the federal. For tax years 2021 and 2022, the american rescue plan act of 2021 (arpa) temporarily expanded eligibility for the premium tax credit by eliminating.

Source: cuspideinsurance.com

Source: cuspideinsurance.com

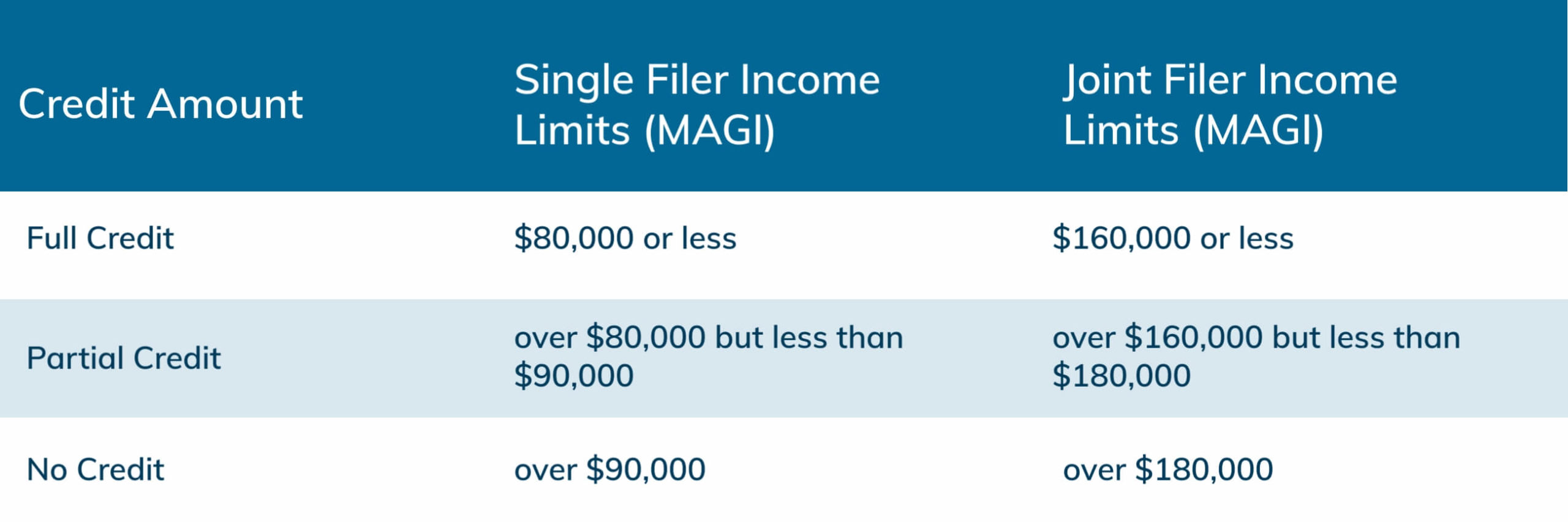

Premium Tax Credit Explained (ACA Subsidies), Premium tax credits for 2024 private health plans through mnsure can be estimated using our estimator tool. When it comes to the premium tax credit, income limits are important to consider.

![Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/w1200-h630-p-k-no-nu/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png) Source: www.apteachers.in

Source: www.apteachers.in

Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax, People with income higher than that may qualify for credits in 2024 if their premiums exceed 8.5% of their household income. For the 2024 tax year, you're eligible for premium tax credits if you make between one and four times the.

Source: refundtalk.com

Source: refundtalk.com

2022 Education Tax Credits ⋆ Where's my Refund? Tax News & Information, There are also dollar caps on. The affordable care act’s premium tax.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Premium tax credit caps for 2024; Congress has extended relief through 2025 for taxpayers who purchase health insurance on a marketplace exchange and want to take advantage of the.

Source: www.healthreformbeyondthebasics.org

Source: www.healthreformbeyondthebasics.org

Yearly Guidelines and Thresholds Beyond the Basics, Our federal poverty guideline list has a 100% poverty level, 138% medicaid expansion. As an example, let’s consider a.

Source: www.taxuni.com

Source: www.taxuni.com

Premium Tax Credit Limits 2024, There are also dollar caps on. As an example, let’s consider a.

Source: nationaldisabilitynavigator.org

Source: nationaldisabilitynavigator.org

Kaiser Brief Examines Tax Credits under ACA Replacement Plans, Premium tax credits for 2024 private health plans through mnsure can be estimated using our estimator tool. What are the advanced premium tax credit repayment limits?

Source: double.carport.za.com

Source: double.carport.za.com

What Is Fica Tax For 2022, 2022, 2023, and 2024 | federal poverty levels (fpl) for aca. The irs on wednesday released an updated applicable percentage table used to determine a person’s premium tax credit for 2024.

In Previous Years, Household Incomes Had To Be Between 100% And 400% Of The Federal.

This means an eligible single person can.

Premium Tax Credit Caps On 2024 Marketplace Coverage Range From 1.92% To 9.12% Of Income Based On The 2023 Federal Poverty Level.

Congress has extended relief through 2025 for taxpayers who purchase health insurance on a marketplace exchange and want to take advantage of the.