Tax Rebate 2024 Solar System

Tax Rebate 2024 Solar System. Here’s an example of how the solar tax credit works: Thanks to the inflation reduction act, the 30% credit is available for.

Here’s an example of how the solar tax credit works: The federal solar tax credit can make improving your energy grid investment a lot more affordable.

Tax Rebate 2024 Solar System Images References :

Source: dailyguardian.ca

Source: dailyguardian.ca

Canadians receiving first carbon tax rebate of 2024, here's when, The solar tax credit allows you to claim a percentage of the cost of a solar power system installation to reduce your owed federal income taxes.

Source: www.usrebate.com

Source: www.usrebate.com

Unraveling The Montana Tax Rebate 2024 Your Comprehensive Guide, If you apply for the tax credit now, you could get a rebate of around $4800 considering the average system costs about $16,000.

Source: printablerebateform.net

Source: printablerebateform.net

Indiana Tax Rebate 2024 Claim Your Tax Savings Today, You must also own the system (no leasing allowed), live in the united states, and installed a new.

Source: printablerebateform.net

Source: printablerebateform.net

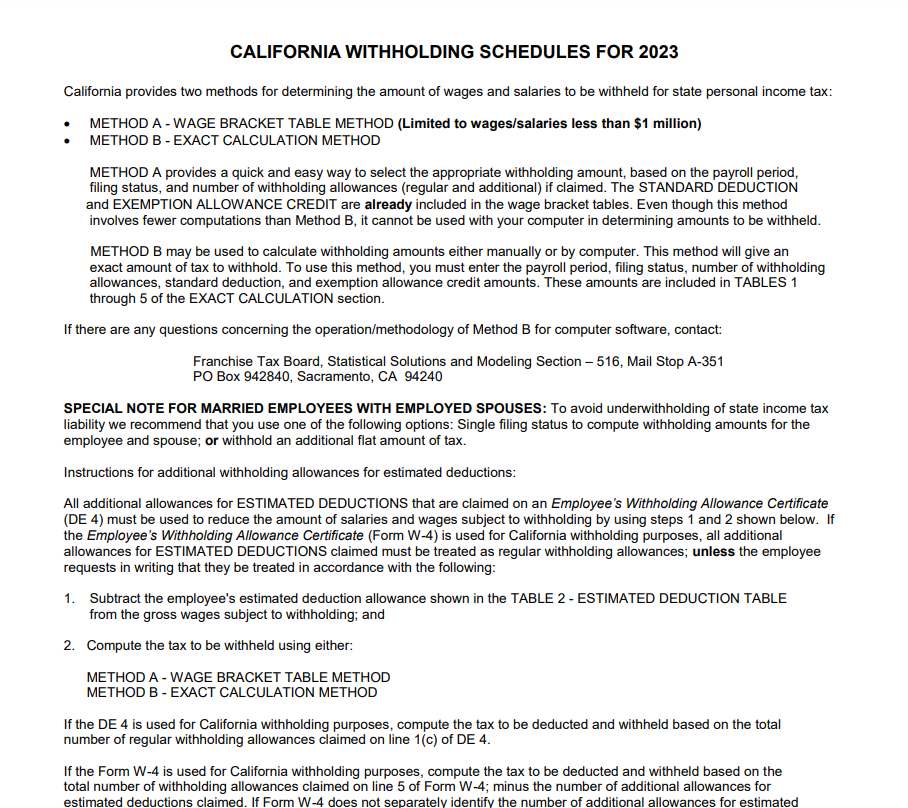

Everything You Need to Know About Arizona Tax Rebate 2024 Printable, In 2024, eligible homeowners can claim a federal income tax credit of up to 30% for solar installation costs, including parts, labor, and permits, until december 31, 2032.

Source: printablerebateform.net

Source: printablerebateform.net

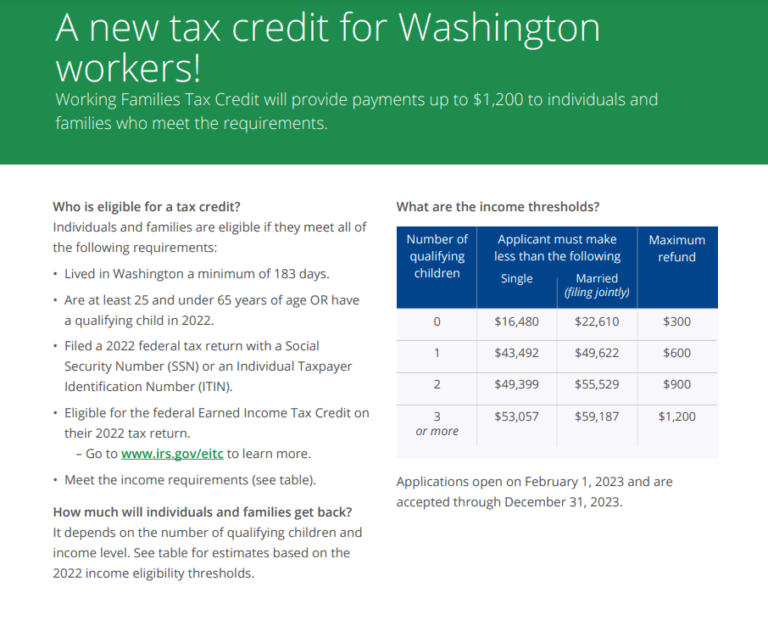

Understanding the Washington Tax Rebate 2024 A Comprehensive Guide, The 2024 federal solar tax credit, also known as the residential clean energy credit, is worth 30% of your total solar system cost for all installations in the u.s.

Source: printablerebateform.net

Source: printablerebateform.net

Tax Rebate 2024 How to Claim and Eligibility Requirements, The residential clean energy credit (also known as the solar investment tax credit or itc) is a tax credit for homeowners who invest in solar and/or battery storage.

Source: printablerebateform.net

Source: printablerebateform.net

California Tax Rebate 2024 Eligibility, Amount and How to Claim, It is a financial incentive for individual taxpayers who install solar panels.

Source: cwccareers.in

Source: cwccareers.in

Canada Tax Rebate 2024 Types of Rebate & Know Payment Eligibility, The federal solar tax credit can cover up to 30% of the cost of a system in 2024.

Source: www.tax-rebate.net

Source: www.tax-rebate.net

2023 Property Tax Rebate Form How To Apply & Eligibility Criteria, You cannot claim the credit more than once.

Source: printablerebateform.net

Source: printablerebateform.net

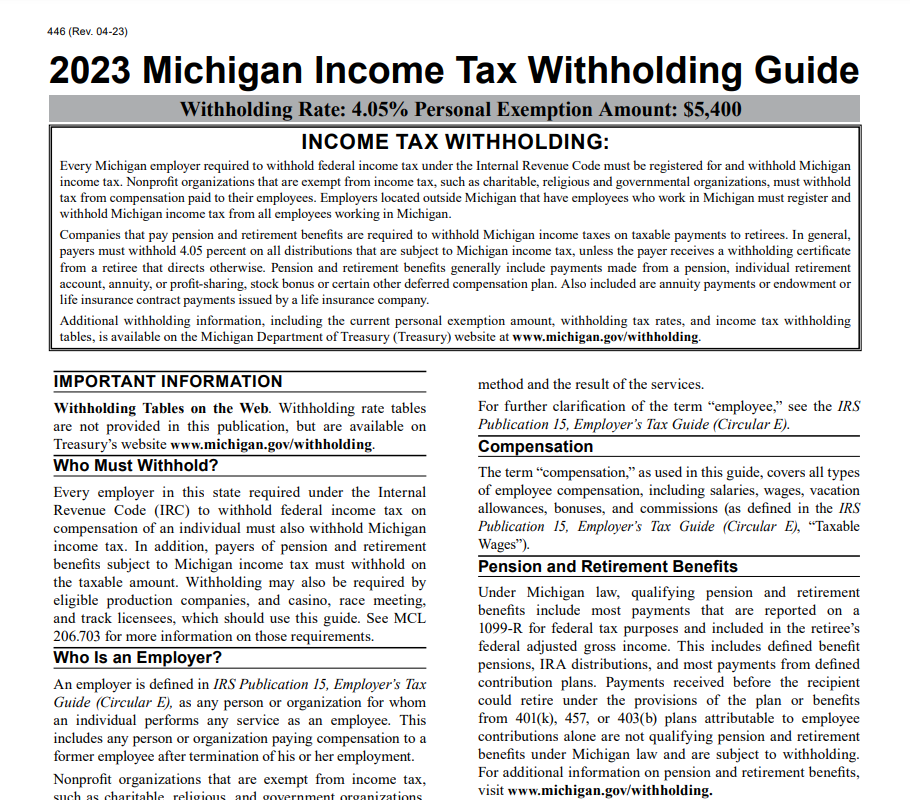

Michigan Tax Rebate 2024 Eligibility, Types, Deadlines & How to Claim, Per the inflation reduction act, the itc is.

Category: 2024